The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

The Short Hedge – No Basis

To give you a better idea of how hedging works, let’s suppose it is May and you are a soybean farmer with a crop in the field; or perhaps an elevator operator with soybeans you have purchased but not yet sold. In market terminology, you have a long cash market position. The current cash market price for soybeans to be delivered in October is $9.00 per bushel. If the price goes up between now and October, when you plan to sell, you will gain. On the other hand, if the price goes down during that time, you will have a loss.

To protect yourself against a possible price decline during the coming months, you can hedge by selling a corresponding number of bushels in the futures market now and buying them back later when it is time to sell your crops in the cash market. If the cash price declines by harvest, any loss incurred will be offset by a gain from the hedge in the futures market. This particular type of hedge is known as a short hedge because of the initial short futures position.

With futures, a person can sell first and buy later or buy first and sell later. Regardless of the order in which the transactions occur, buying at a lower price and selling at a higher price will result in a gain on the futures position.

Selling now with the intention of buying back at a later date gives you a short futures market position. A price decrease will result in a futures gain, because you will have sold at a higher price and bought at a lower price.

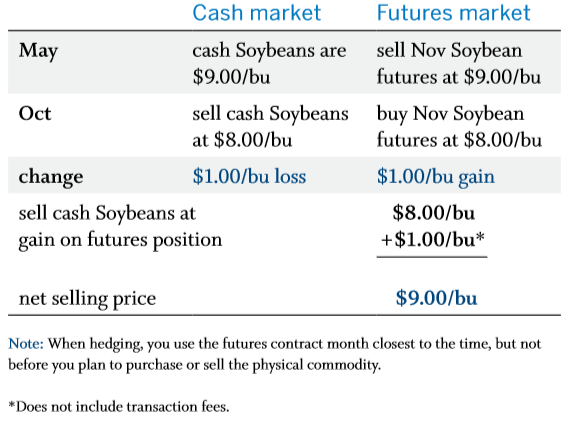

For example, let’s assume cash and futures prices are identical at $9.00 per bushel. What happens if prices decline by $1.00 per bushel? Although the value of your long cash market position decreases by $1.00 per bushel, the value of your short futures market position increases by $1.00 per bushel. Because the gain on your futures position is equal to the loss on the cash position, your net selling price is still $9.00 per bushel.

This email address is being protected from spambots. You need JavaScript enabled to view it.

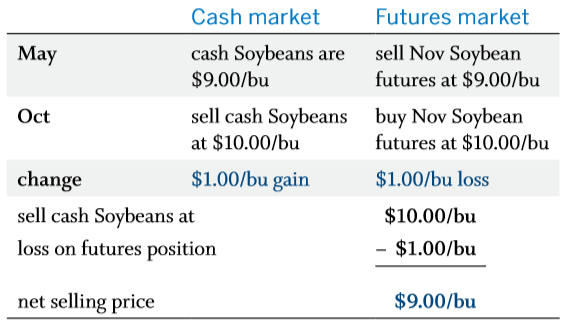

What if soybean prices had instead risen by $1.00 per bushel? Once again, the net selling price would have been $9.00 per bushel, as a $1.00 per bushel loss on the short futures position would be offset by a $1.00 per bushel gain on the long cash position.

Notice in both cases the gains and losses on the two market positions cancel each other out. That is, when there is a gain on one market position, there is a comparable loss on the other. This explains why hedging is often said to “lock in” a price level.

In both instances, the hedge accomplished what it set out to achieve: It established a selling price of $9.00 per bushel for soybeans to be delivered in October. With a short hedge, you give up the opportunity to benefit from a price increase to obtain protection against a price decrease.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.