The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

The Long Hedge – No Basis

On the other hand, livestock feeders, grain importers, food processors and other buyers of agricultural products often need protection against rising prices and would instead use a long hedge involving an initial long futures position.

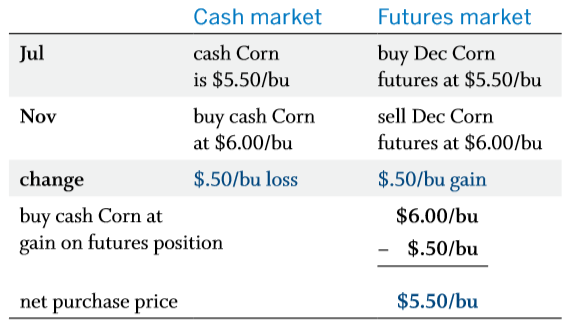

For example, assume it is July and you are planning to buy corn in November. The cash market price in July for corn delivered in November is $5.50 per bushel, but you are concerned that by the time you make the purchase, the price may be much higher. To protect yourself against a possible price increase, you buy Dec Corn futures at $5.50 per bushel. What would be the outcome if corn prices increase 50 cents per bushel by November?

This email address is being protected from spambots. You need JavaScript enabled to view it.

In this example, the higher cost of corn in the cash market was offset by a gain in the futures market.

Conversely, if corn prices decreased by 50 cents per bushel by November, the lower cost of corn in the cash market would be offset by a loss in the futures market. The net purchase price would still be $5.50 per bushel.

Remember, whether you have a short hedge or a long hedge, any losses on your futures position may result in a margin call from your broker, requiring you to deposit additional funds to your performance bond account. As previously discussed, adequate funds must be maintained in the account to cover day-to-day losses. However, keep in mind that if you are incurring losses on your futures market position, then it is likely that you are incurring gains on your cash market position.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.