Hedging FX Risk on Commodities

Evaluating the impact foreign exchange rates shifts can have on your profitability whether you're exporting as a producer or purchasing as an importer of bulk raw commodities is certainly worthwhile. Below is an illustration showing how hedging FX risk aside from commodity price risk could further reduce costs.

By using our website, you agree to accept our terms of use (click to read)

Commentary

Historically, trade between both the United States and Canada has been strong.

The new United States-Mexico-Canada Agreement (USMCA) is an agreement between the United States of America, United Mexican States and Canada. It's been characterized as "NAFTA 2.0 and formally signed on November 30, 2018. In a nutshell, it helps faciliate trade between the 3 nations anticipated to generate jobs and productivity benefiting North America as a whole.

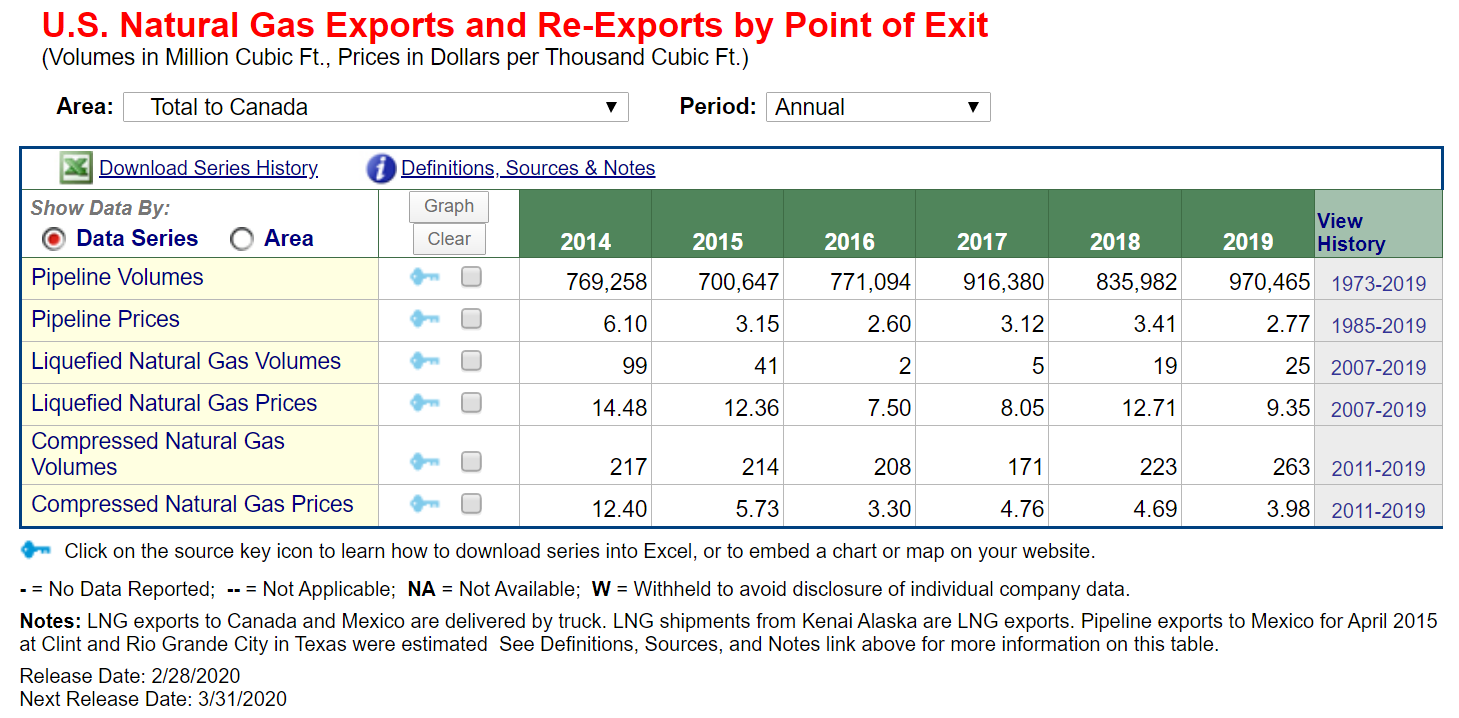

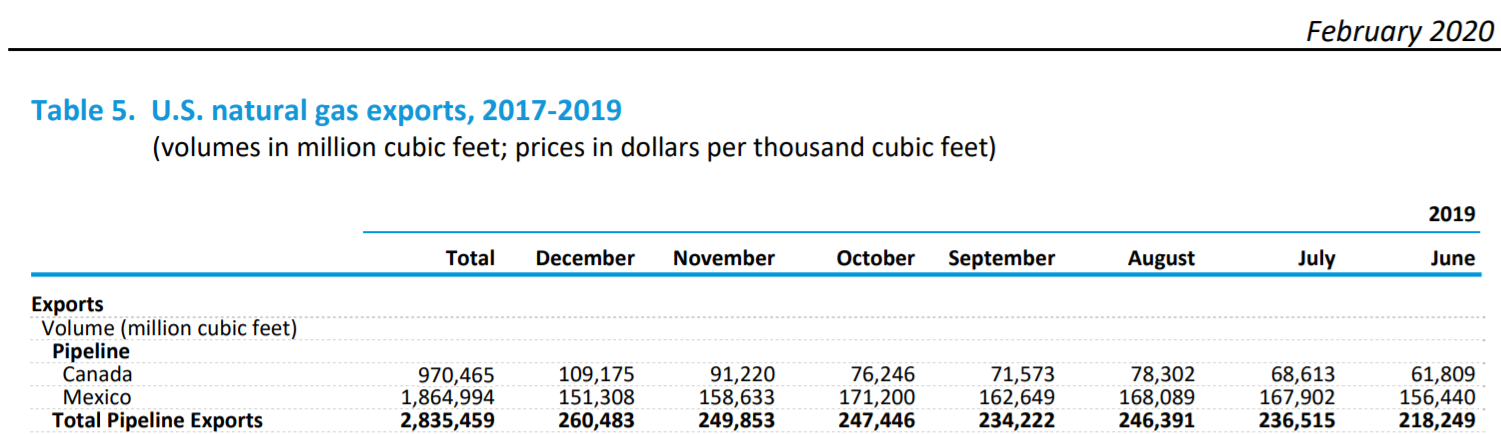

U.S. natural gas exports to Canada in 2018 averaged 2.3 Bcf/d, valued at more than $2 billion, and they mainly went to the eastern provinces. U.S. natural gas exports to Canada by volume was 970,465 million cubic feet for 2019.

Charts

As of this post, natural gas prices have fallen since the start of 2020.

The same has occurred with the CAD/USD given the strong correlation of the "loonie" to energy prices.

Notes:

Contract Size - 10,000 million British thermal units (mmBtu).

Tick Size: U.S. Dollars and Cents per mmBTU

Trading Hours: Sunday - Friday 6:00 p.m. - 5:00 p.m. (5:00 p.m. - 4:00 p.m. Chicago Time/CT) with a 60-minute break each day beginning at 5:00 p.m. (4:00 p.m. CT)

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Natural Gas futures and options

FX Hedging: CAD/USD

Concepts on hedging price risk of natural gas here can be similarly applied to any commodity being exported from a producer in one country to a buyer in another.

The Canadian dollars to U.S. dollars exchange rate is significant as trade is generally priced in USD. FX futures traded in Chicago are denominated in U.S. dollars (CAD/USD) and can be used as a hedging tool.

This article will focus on the foreign exchange part of the equation where an importer of natural gas needs to pay in the producer's currency. The importer's position is to manage risk of appreciation of the seller's currency upon delivery.

Canadian Refinery (Importer)

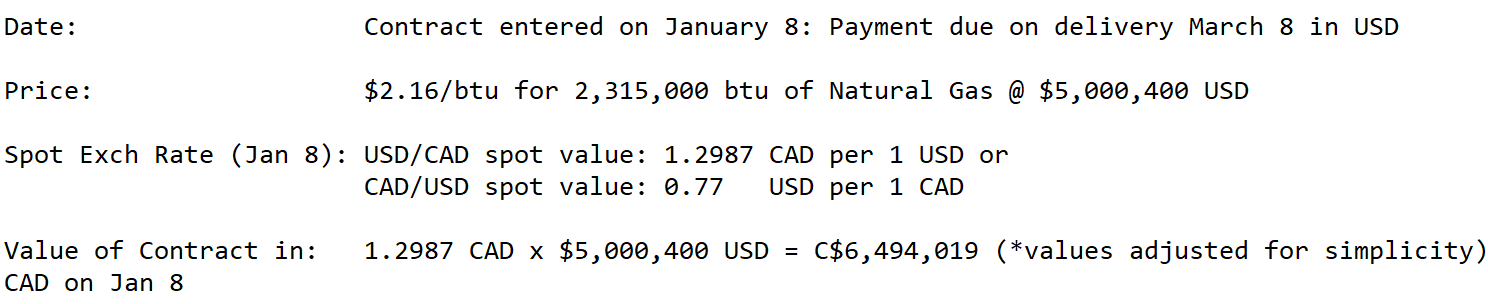

The following example will illustrate a Canadian refinery importing natural gas from a U.S. producer and agreeing to pay in USD upon delivery. For this article, we'll evaluate the impact of an appreciating USD/CAD to the refiner. For simplicity, the example won't consider factors as basis, commissions or fees.

Assuming on Jan 8th, a Canadian refinery has already hedged its physical price risk of rising natural gas prices in anticipation of weather and higher storage withdrawals. With gas prices at 2.16/btu, assume the refiner purchased Henry Hub NG futures, call options or forward contracted delivery to protect against an increase in gas prices. In hindsight, the natural gas chart above showed a slight increase at the start of the New Year before falling to significantly lower gas prices now.

Suppose in January, the Canadian refinery contracted to purchase gas from the U.S. producer for delivery in March. The agreement is where the producer / exporter will be paid on the delivery date in March at an agreed upon aggregate price of approximately $5,000,400 USD.

In January, the USD/CAD exchange rate was around 1.2987 Canadian dollars per U.S. dollar. So, between January and March the Canadian importer will be "short" ~$5,000,400 U.S. dollars (USD/CAD) and "long" C$6,494,019 CAD as the anticipated amount to convert CAD to USD on Jan 8th.

The C$6,494,019 represents the Canadian producer's risk exposure at the start since the exchange rate could fluxuate as seen from the above chart. FX risk for the Canadian refinery is appreciation of the USD to CAD meaning more Canadian dollars would be required for conversion to USD to meet the $5,000,400 delivery payment.

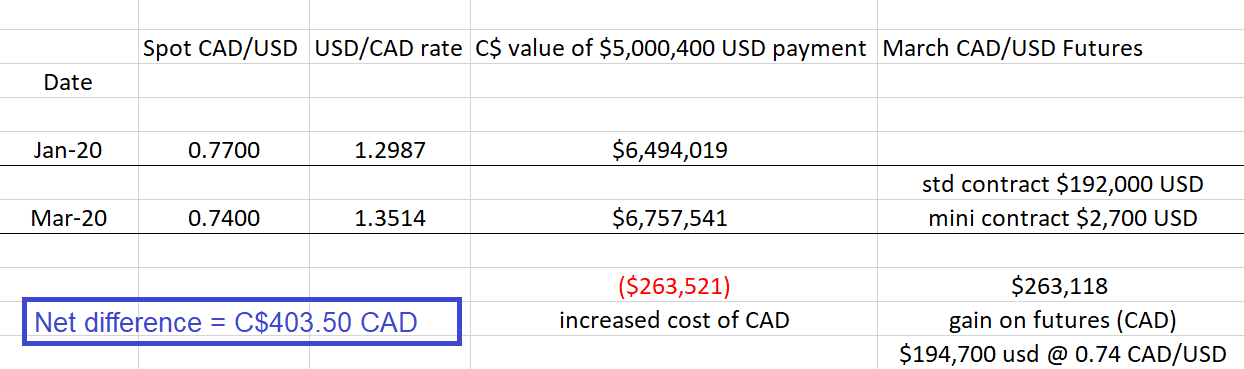

Scenario: USD/CAD rate increase

Consider a scenario where the USD/CAD rate increases from 1.2987 to 1.3514 by March delivery. In order to meet the $5,000,400 USD payment, the Canadian refinery has to convert more Canadian dollars per USD given the rate change.

The chart below illustrates USD/CAD. Note how the USD appreciated from the start of January to current.

Hedging with FX Futures

The table below summarizes the impact on a USD appreciation in relation to the CAD. With an unhedged position, the Canadian importer would need an additional C$263,521 CAD with an appreciation of the U.S. dollar.

The Chicago Mercantile Exchange (CMEGroup) offers FX Futures on the inverse of the spot pair being CAD/USD. In order to mitigate FX risk, the importer could opt to sell CAD/USD futures or purchase put options to offset the rise in cost. It is the inverse of the spot pair.

In order to adequately cover the value at risk, the importer would need to calculate a hedge ratio of 100,000 units of CAD per standard futures contract against the value of Canadian currency at risk (C$6,494,019). With a hedge ratio of around 64.94, rather than rounding up the number of standard contracts, CME also offers mini futures contract at 10,000 CAD/USD or 1/10th the size. So, the combined hedge in this example is 64 standard and 9 mini CAD/USD futures contracts. With the appreciation of the USD against CAD, the increased cost to the importer is offset by a gain in the futures hedge.

It's also important to note that a hedging program on physical commodities or FX entails more than a "set-it-and-forget" approach. Developing an active plan around price volatility could possibly yield further cost reduction above. Working with option and basis spreads that re-balance derivative hedges takes time to plan and manage which is what our team at Oahu Capital Group can help with.

Please contact us if you'd like assistance with your business by scheduling a call back. Or, take a few minutes to watch our Free on-demand webcast below. See futures and options in action as hedging tools.

Discussion on Basis:

For simplicity, the example used to illustrate the benefits of the futures hedge, the FX futures prices used were the same as the spot rate at the time of the transaction.

In practice, there is likely to be a slight difference between the CAD/USD futures price and spot rate. The difference between the spot rate and the future or forward represents the “basis,” essentially the futures price minus the spot price of the currency pairing. The basis is driven by the same factors that affect the price of forwards in the interbank markets – the relationship between short-term interest rates associated with the term and base currency.

Over time, the basis will tend to converge towards zero because the impact of differential short-term rates becomes less relevant as the futures contract expiration approaches. Once the futures contract becomes deliverable, it becomes a direct proxy for the spot delivery of the currency, and the basis is said to “converge to zero.”

Did you find the post helpful? Watch a brief video where I show an illustration on managing risk using futures and option strategies.