For processors, improving profit margins means hedging resin costs consistent with product prices and risks. But how (and how best) to hedge resin costs? That topic will be much discussed in Profitable Plastics. For now, some front-end basics...

What is a resin cost hedge?

A resin cost hedge is protection against 1) financial loss in an existing physical purchase or 2) a higher price than acceptable in a future physical purchase. Hedges are usually financial, and cheaper and less risky, than outright physical purchases. Hedges should protect next month forward purchases, not short-term (current month) needs.

[Aside: Hedging is often associated with options since options were created as hedging tools. For a defined cost and limited risk, options allow buyers and sellers to create positions that exactly meet their hedging needs and market outlook.]

This email address is being protected from spambots. You need JavaScript enabled to view it.

Accounting for Hedges

Resin cost hedges are alternatives to physical purchases; therefore, hedging gains and losses should be accounted for in the eventual purchase price of the resins they are meant to protect to arrive at a net purchase price. If an existing hedge cannot be linked to a physical purchase by the person responsible for the hedge, it’s speculation. Hedges are not speculation and speculation is not hedging! For some, speculation within approved limits is fine, but don’t blame hedging for a bad bet.

The Forward Curve

The starting point for a hedging decision is the forward curve. The forward curve is a monthly chart (as of a certain date) of expected, future prices for a commodity. The best forward curves come from an unbiased, well-informed source. For energy and many other commodities, that source is the futures market. What about resins?

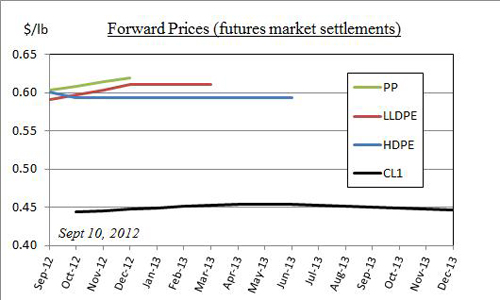

Financially settled futures are available in polypropylene, linear low-density polyethylene film, and high-density polyethylene. (These are calendar swaps where the floating price for a contract month is equal to the arithmetic average of Petrochem Wire’s daily closing price (FOB Houston) for the resin for each business day during the contract month.) The forward curves for those resins, alongside the forward curve in crude oil (converted to $/lb), are shown here:

Forward curves tell processors what resin costs to plan for and, depending on the level and volatility of the forward curves, whether or not hedges are warranted.

How may processors hedge resins costs?

If, after reviewing the forward curve, a polypropylene or polyethylene processor decides to hedge, are resins futures the only tool available? And what about PET, PVC, polystyrene, and other resins processors? What hedging tools are available to them? Stay tuned.

About the author: Tom Langan is Risk Manager - Refining & Petro Chemicals for Oahu Capital Group (Asia) Pte. Ltd. Tom has over 20 years of experience in commodity, options trading and risk management. He has developed and implemented risk management programs for electricity, natural gas utilities, oil companies and plastics processors.