Trade Options on Futures

Live Cattle * Directional & Neutral Positions

Get your copy of Paul Forchione's book, "Trading Iron Condors". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Commentary: Straits Financial

August 07, 2020

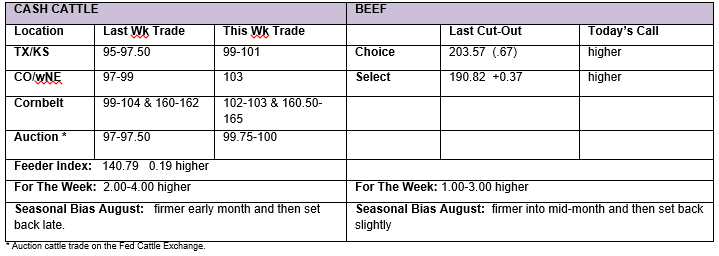

Livestock: The northern trade turned active on Thursday with prices higher as was expected and in line with the gains seen earlier in the south, but still maintaining their premium to the south. Numbers remain tighter in the north and that will not change for a while, although there will be a segment of the northern trade (farmer feeders) that could eventually come back into the market as sellers of some very big fat cattle as they finish off last year’s corn and walk it to the market. There could still be a little more trade on the week today, but for the most part we are done. Next week look for firmer prices in spite of the soft futures trade this week so far.

Beef: Boxes were higher on Thursday. The week-to-date choice cutout is up 1.40 cents and the select is up 2.12 cents to keep our expectation for a 1.00-3.00 higher beef trade in line. Through Thursday the slaughter is 10k head below last week at the same time. There is talk that a plant could be dark on Saturday and so it looks unreasonable to expect the kill to recover much if any of what it has lost on the week. USDA has been over-stating the actual fat cattle slaughter of late and this week coming in light on the total FI kill probably holds that trend. Packers continue to do a good job in matching up supply levels with the real demand from the market considering the disaster that is developing in the restaurant sector. We will come into next week thinking slightly stronger on the cutouts.

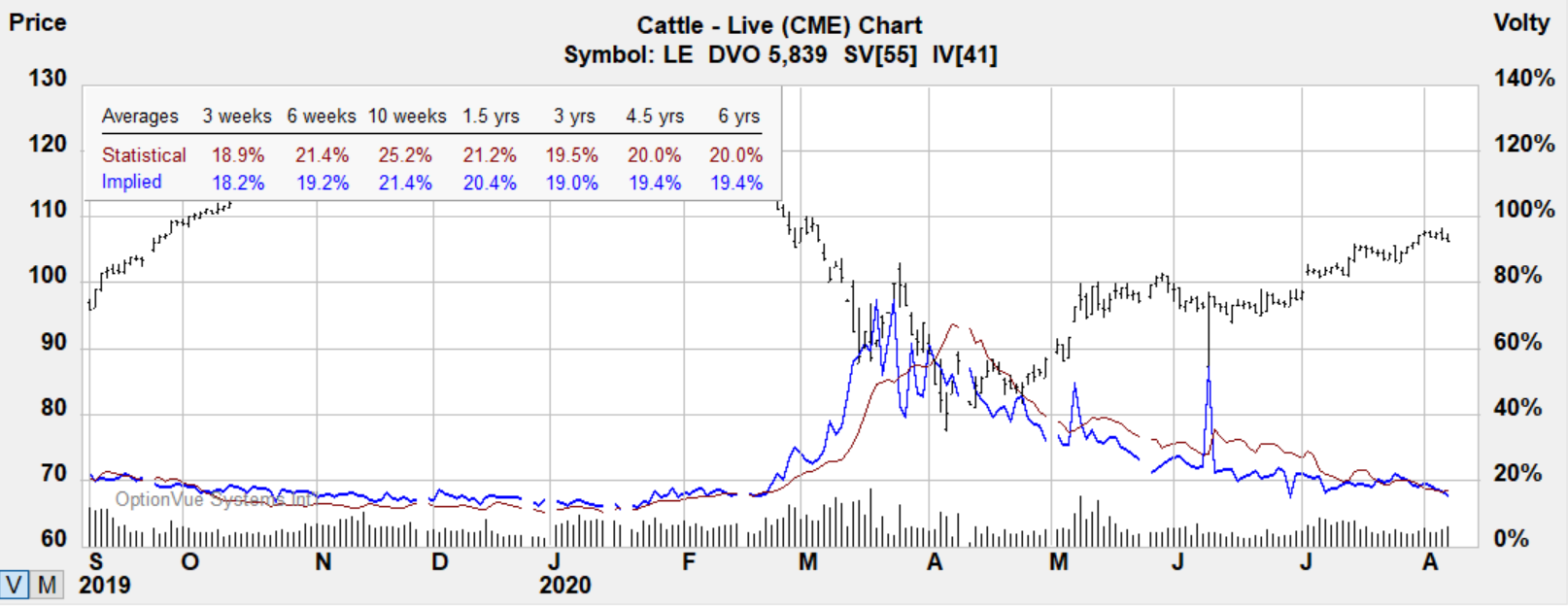

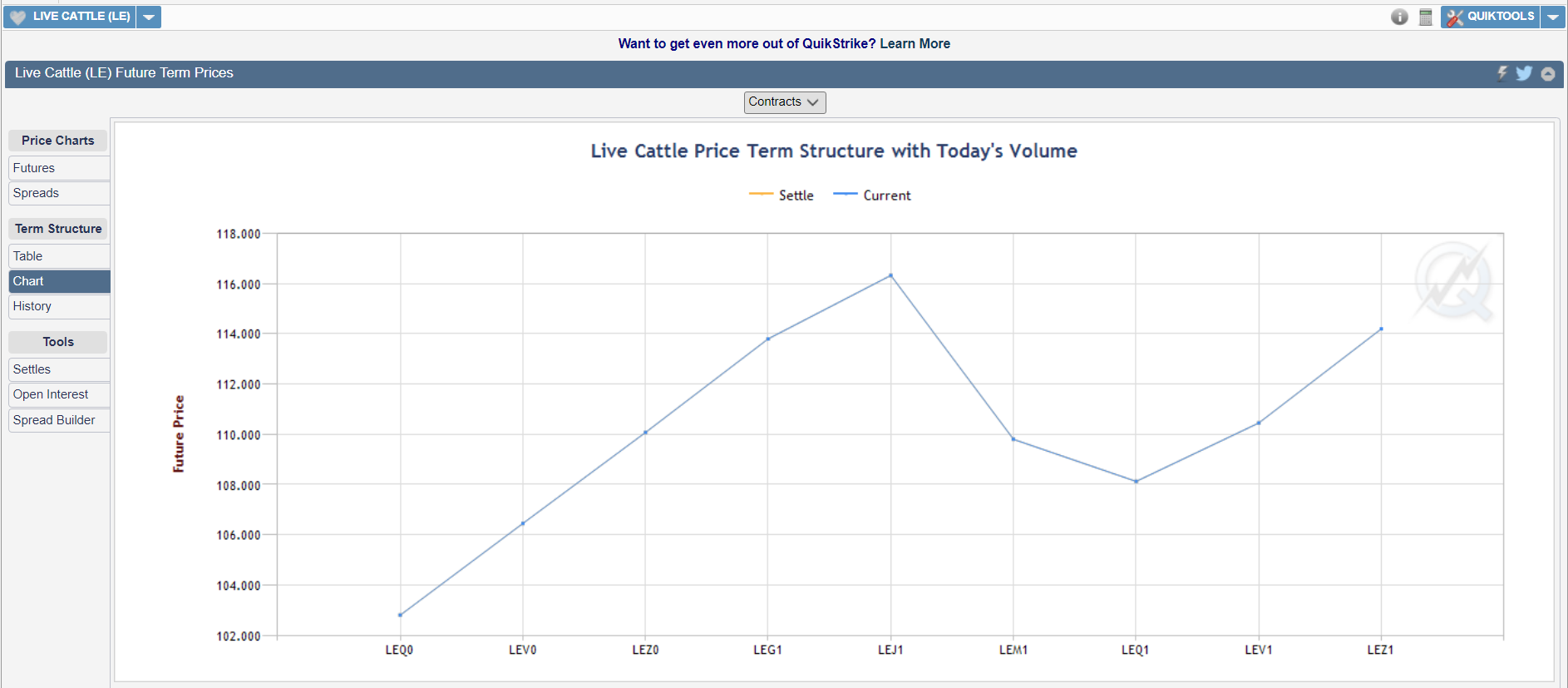

Futures: With the exception of the front month August, all contract months in the live castle futures were able to post a new trading high for the four-month rally and then traded back lower to complete a big reversal pattern on the daily charts. The volume of trade was a little better at 56k contracts traded and once again, open interest increased regardless of whether the futures were trading higher or lower. From the bullish perspective, the chart reader side of things will probably take a short pause here and make sure that this questionable market action is not leading to a major problem. From the fundamental side of things, cash fats are stronger and beef is firmer with no reason from our perspective to feel that this bullish trend will not carry on a little longer. Today is August live cattle option expiration. With the August settlement at 102.62 cents yesterday and the cash trade firming, look for the futures to make an early run at the 104 cent level instead of the 102 strike and then back off to end well between these levels…102 being too cheap and 104 a little rich. Monday is First Notice Day. Wednesday, August 12th is the next monthly grain reports, and the Cattle on Feed is Friday, August 21st.

Basis: The August live cattle futures closed on Wednesday at 102.62 cents, up 0.32 cents on the day and down 0.20 cents on the week, while the cheapest to deliver cash trade in the south has been 2.00-3.00 cents higher than last week at 99 to 101 cents…mostly 100…leaning higher. The lower board and higher cash on the week so far have done the job in tightening the negative basis into the level were large amounts of southern deliveries will not be a feature for starters next week…unless we get a strong futures rally today which we are not looking for.

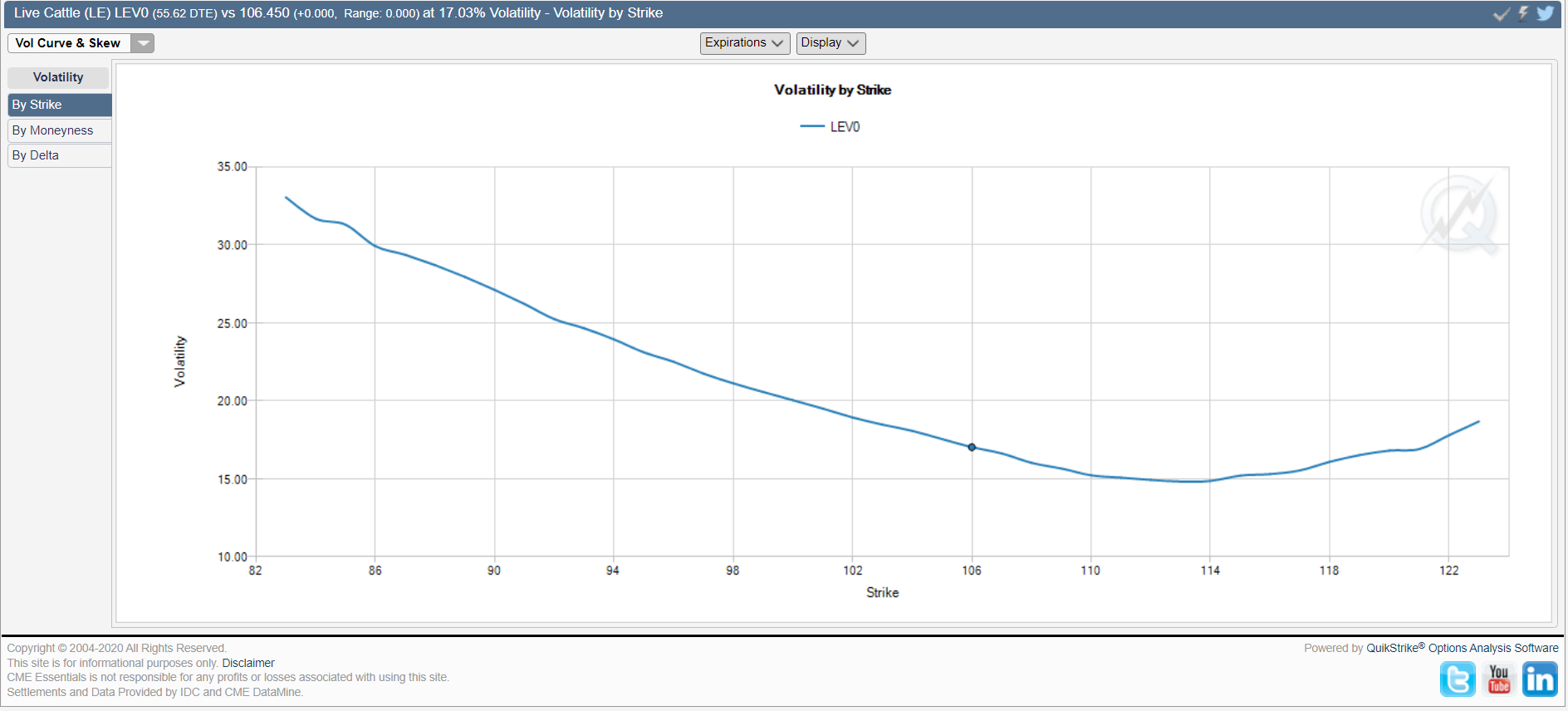

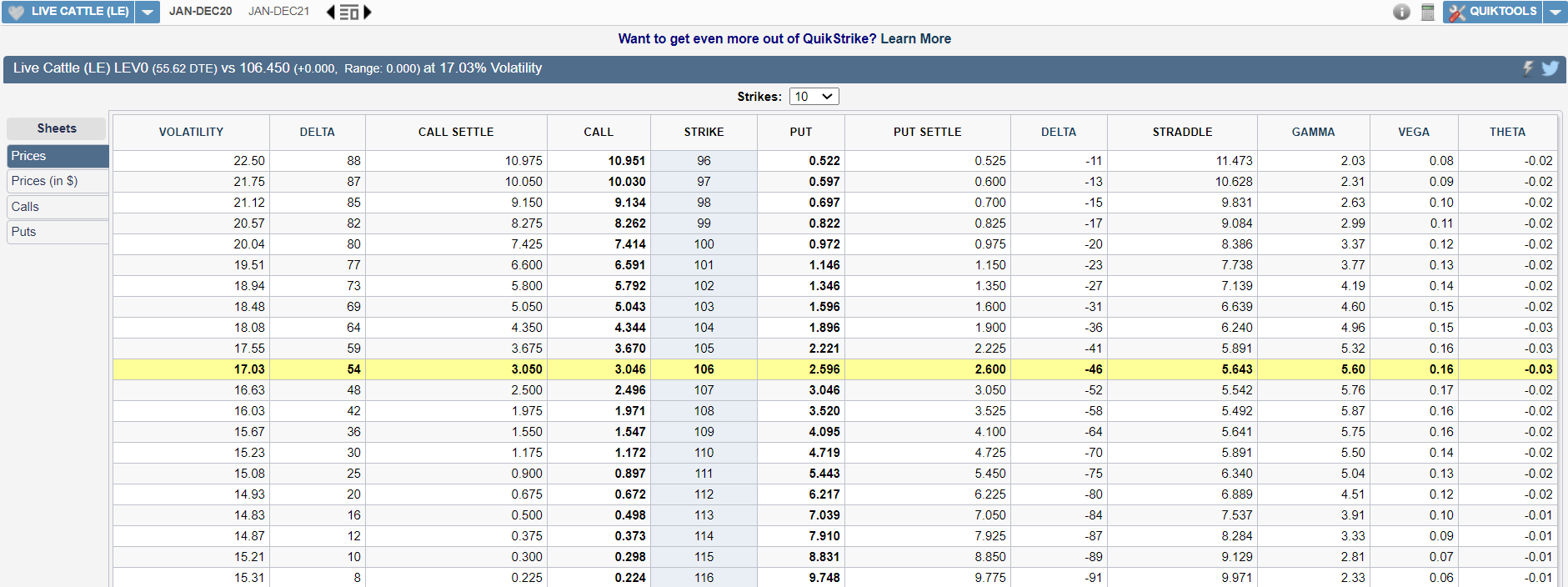

Volatility

Term Structure

Notes:

Contract Size - 40,000 lbs (~ 18 MT)

Tick Size: $.00025 per pound (=$10 per contract)

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Live Cattle futures and options

Live Cattle

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

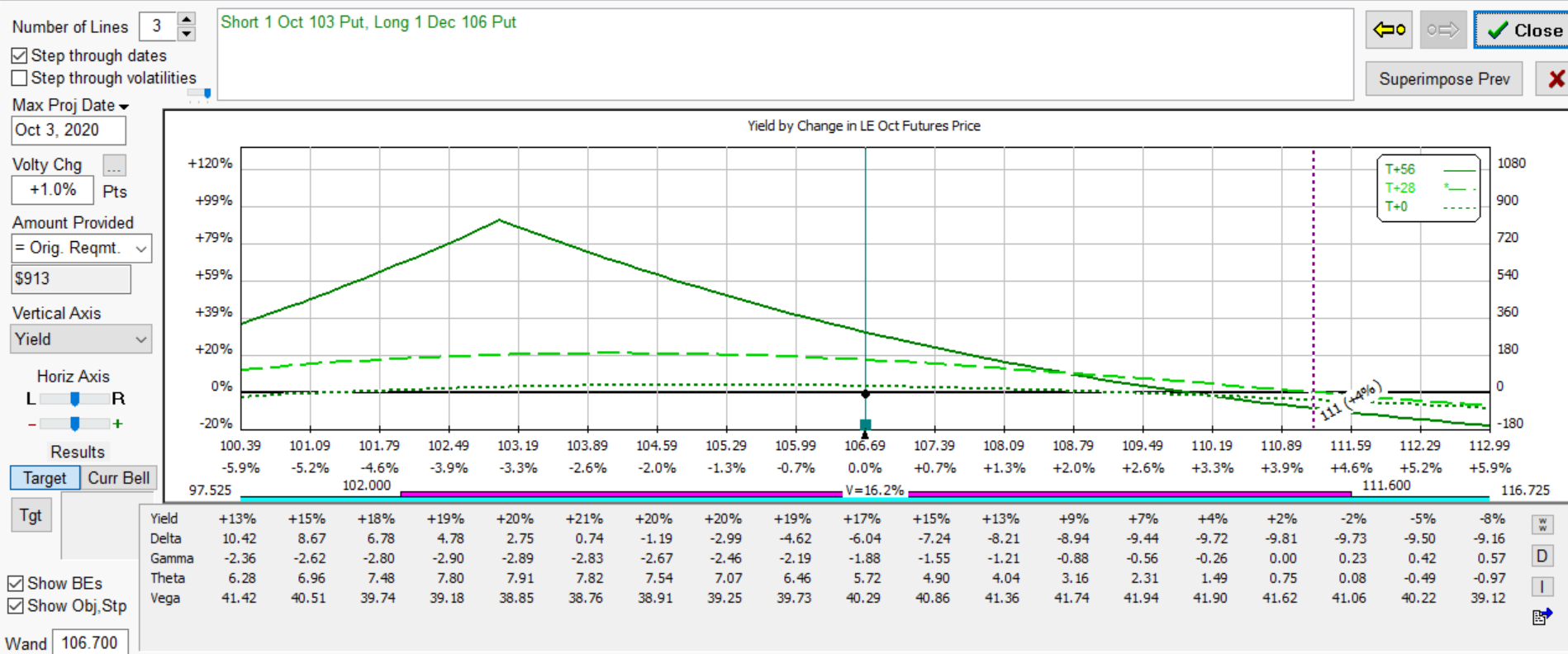

Strategies

Below illustrates a calendar It has positive time decay and benefits from a increase in volatility. The option spread covers a price range where a slight increase in implied volatility offers a theoretical edge. The position would lose if price moved beyond range extremes or volatility declined.

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below per 1 LOT. The structure has positive time decay which is an advantage over holding outright options. The strategy is for educational purposes only and not meant to be taken as trading or investment advice.

Join our Free Webcast each month and learn how these strategies can benefit your trading.